Student debt relief is controversial. Many former students struggle under significant debt loads. However, many others never attended college or have already repaid their loans. The Biden administration has announced student debt relief of up to $10,000. However, this has been challenged at court.

Michael Burry has not criticized student debt relief.

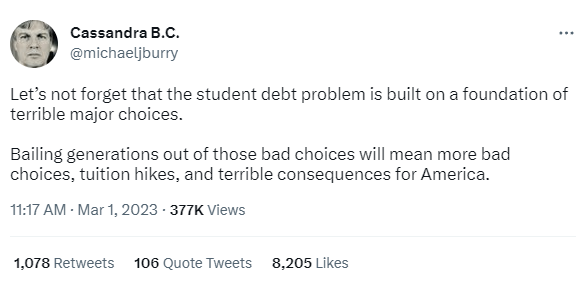

Michael Burry makes several inter-related points.

Student debt issues are due to students choosing bad colleges or majors and that these majors would never enable them to repay their loans.

Bailouts create bad incentives. This would encourage students to continue pursuing low paying degrees.

Michael Burry was silent – at least in this exchange – about how student loans are structured. However, the question is whether he has a point.

Are college majors the problem?

College majors can be a problem. Many majors pay poorly. Michael Burry does have a solid point in many respects. Myriad college rankings exist. Myriad outlets publish graduate salaries. Thus, for many majors, people can do due diligence.

Michael Burry does miss nuance. Many poorly paying majors are in education. This creates a challenge. The government – and society – could have an incentive to encourage people to study education. Reducing college costs might achieve this, albeit with the unintended consequence of not necessarily incentivizing high achievers. Alternatives exist. These include performance bonuses for highly performing teachers so as to make the debt load sustainable.

It is also important to note that some colleges are predatory and hype themselves, or degrees, in a misleading manner. This does not absolve students who do badly from failing to obtain a job. However, it does mean that some claims warrant closer scrutiny. Fortunately, many rankings do precisely this. And it is important to do due diligence.

Unintended consequences?

Michael Burry is correct to highlight unintended consequences. If the government bails out people from their bad decisions, it enables them to repeat those decisions safe in the knowledge that they get all the upside but pay less of the downside. In this context, bailouts are not “free”. The tax payer pays. However, the person receiving the bailout is unlikely to pay the full cost via taxes: rather that is likely to come from other tax payers.

Michael Burry might overstate the concern in some respects: a one off $10,000 payment might not shift behavior by itself. However, the concern is that there is no obvious limiting principle. Why only one payment? Why only $10,000? Why stop with this cohort of people? The lack of limiting principle opens the bailout to expansion. And, even a non-zero chance of this can create unintended consequences.

Michael Burry therefore does make a valid point. He might overstate some of the risks. And his comments might lack nuance. However, he flags genuine concerns with the loan forgiveness plan that the Biden administration should address when providing debt relief.

Share this post