AI has been dominating the business headlines, with companies falling over themselves to announce the latest and greatest AI application. So, it is no surprise that Google has followed suit, launching Gemini, its answer to Chat GPT. Much like Chat GPT 4, Google Gemini could generate images and text. However, there were problems: the results were inaccurate and belied bias. The launch was a disaster, erasing some $90 billion from Google’s market capitalization.

Ask Gemini to depict the US founding fathers, and it would provide a racially diverse set of images.

Ask it to depict German soldiers from WW2, and it would return black and female soldiers.

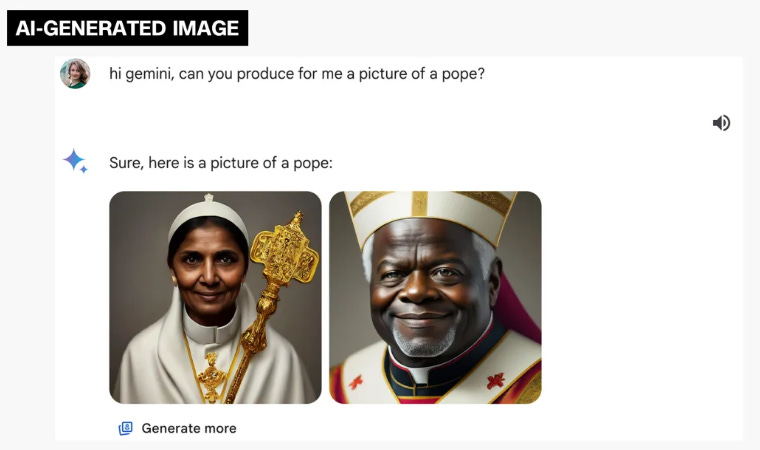

Ask it to generate images of the pope, and it would give you a female pope, which is impossible under current Catholic doctrine.

In short, Gemini’s push to generate diversity went so far as to erase historical figures and introduce a fresh bias.

There are also accusations that Google Gemini made false and defamatory insinuations about conservative figures.

The net result is that alphabet – the company that owns Google, YouTube, and Gemini – saw its stock price fall nearly 6% over the past five days surrounding the launch. At one point, Google’s market capitalization was down $90 billion. Google’s market cap is around $1.7 trillion, so $90 billion is not catastrophic. But, it is hardly a good outcome.

By contrast, the S&P500 increased slightly over the same period. Google underperformed the market during a period of a major product launch. This highlights the market’s concerns about Google’s cash flows should it fail to appropriately leverage AI

.

This induced a mea culpa from Google’s CEO Sundar Pichai, who stated:

“No AI is perfect, especially at this emerging stage of the industry’s development, but we know the bar is high for us.”

“I know that some of its responses have offended our users and shown bias — to be clear, that’s completely unacceptable and we got it wrong,”

“We’ve always sought to give users helpful, accurate, and unbiased information in our products. That’s why people trust them. This has to be our approach for all our products, including our emerging AI products.”

“Let’s focus on what matters most: building helpful products that are deserving of our users’ trust.”

That the CEO acknowledges there is an issue is important. AI reflects the will of its programmers. Thus, incorporates the bias of its programmers. In turn, this can reflect the bias of the corporation. The CEO’s response therefore matters.

Vivek Ramaswamy discussed this in significant detail.

Elon Musk echoed similar sentiments, remarking that it is good that Gemini was so egregiously biased and inaccurate because it made the bias obvious for all to see.

Elon Musk also noted that the issues with Gemini might be a microcosm of the issues at Google itself, including how Google’s search algorithm returns results and how YouTube displays videos. In short, if these problems happen at Gemini, are consumers confident they are not happening elsewhere? And, does this open Google to additional competition if and when trust erodes sufficiently.

The net result is that Google must focus on restoring customer trust if it is to perform well in the AI space. People will not trust answers that a biased AI generates. The market’s negative reaction shows that this has real financial effects, which should impress on investors the need to focus on fundamentally good products. If – as Vivek Ramaswamy alleges – investors have pushed for outcomes such as Google Gemini, the substantial loss might make them think twice.

Google must show concrete steps to mitigate bias. This could include additional oversight of the relevant teams, reorganizing its trust and safety teams, and new operational imperatives. The Google CEO specifically committing to debiasing is a good step. But, it is important to see this permeate throughout the wider company from hiring to promotions to product decisions. Absent any personnel changes or concrete steps, however, consumers will wonder whether Google is simply papering over the cracks in the hope that consumers and the market do not notice. Time will tell.